Taxation News

Property Tax Statements Have Been Mailed; Where Does Your Money Go?

The Columbia County Finance and Taxation Department mailed annual property tax statements to property owners last week. Payments are due by November 15, 2024.

Property taxes fund critical public services, including law enforcement, fire and emergency services, parks, schools, public transportation, public defense, elections, community justice, and other essential municipal functions.

This year, Columbia County will collect $102,766,111.39 in property taxes from businesses and private landowners. However, the majority of this revenue doesn’t stay with the county—only about 9.47% (roughly $9.73 million) goes into the county’s general fund. An additional 3.90% ($4.01 million) is allocated to the Jail Operation Fund, supported by a local option levy approved by county voters. A second local option levy for the Sheriff’s Office will generate over $2 million (1.95% of the total tax collection) through the Enhanced Law Enforcement levy.

General fund dollars primarily support county law enforcement and public safety, including the Columbia County Sheriff’s Office, jail operations, and the District Attorney’s Office. The remainder funds general county administration, including the Assessor’s Office, Land Development Services, Juvenile Services, and the County Commission. Over 90% of property tax revenues are distributed to local schools, city governments, and special districts, such as those managing 911 services or soil and water conservation.

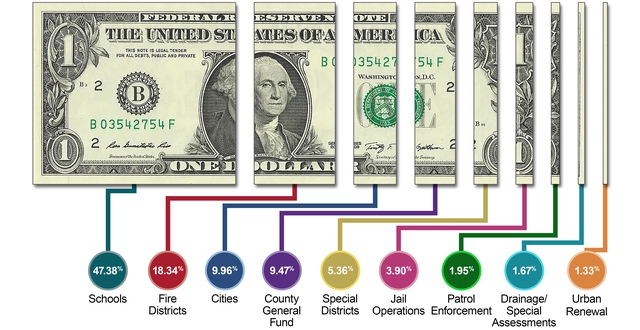

Here’s the breakdown:

- Schools: $48,693,307.68 – 47.38%

- Fire Districts: $19,503,749.86 – 18.98%

- City Governments: $10,231,399.97 – 9.96%

- Columbia County Government: $9,730,901.84 – 9.47%

- Special Districts: $5,506,228.47 – 5.36%

- Jail Operations: $4,012,882.67 – 3.90%

- Patrol Enforcement: $2,007,482.30 – 1.95%

- Drainage/Special Assessments: $1,715,720.41 – 1.67%

- Urban Renewal: $1,364,438.19 – 1.33%

- TOTAL: $102,766,111.39

Tax rates vary depending on the mix of taxing districts in each tax code area. Columbia County has 88 tax code areas, and your property tax statement reflects the amount collected for the services provided in your area. Residents of cities often pay higher taxes than rural property owners because their taxes fund additional services like city parks, libraries, or voter-approved bonds.

Your tax code number is located in the upper left corner of your property tax statement. To view the specific charges for your tax code area, visit the county Assessor’s webpage at columbiacountyor.gov and open the 2024-25 Summary of Assessment & Tax Roll, which lists all agencies receiving property taxes.

The largest share of tax revenue—47.38%—supports education, which includes five school districts, one educational service district, and Portland Community College.

Fire districts receive over 18.98% of total tax revenue, serving the entire county from Vernonia to Clatskanie to Scappoose.

# # #

ABOUT COLUMBIA COUNTY'S PROPERTY TAXES

The County Tax Assessor, an elected official, regulates property taxes based on the most recent property value assessments for homes, businesses, and land. For more information about your Columbia County property valuation, or if you believe your property tax assessment is inaccurate, contact the County Assessor’s Office at 503-397-2240. All tax appeals must be filed with the County Clerk by December 31, 2024.

Property Tax Statement Mailing Begins October 20; Where Does Your Money Go?

The Columbia County Finance and Taxation Department will begin mailing property owners their annual tax statements on October 20. Payments are due by November 15, 2023.

Property taxes pay for a number of critical services. These include public safety (law enforcement, fire, and emergency services), parks, schools, public transportation, public defense, elections, community justice, and a host of other important municipal services.

Columbia County will collect $98,331,192 in taxes from businesses and private landowners this year. The majority of that amount doesn’t stay in county coffers – about 9.2 percent, or roughly $9 million, goes into the county’s general fund. An additional 3.83 percent, or $3.7 million, goes to the Jail Operation Fund from the local option levy approved by county voters. A second local option for the Sheriff’s Office is new to the tax roll this year. The Enhanced Law Enforcement levy will bring in over $1.8 million and accounts for 1.92 percent of the total tax to be collected.

General fund dollars largely pay for county law enforcement and public safety, including Columbia County Sheriff’s Office, jail operations, and the district attorney’s office. The remainder pays for general county administration, including the assessor’s office, land development services, juvenile services, and the county commission. More than 85 percent of property tax funds collected are distributed to local schools, cities, and special districts, such as those that manage 911 services or soil and water conservation, to name a few.

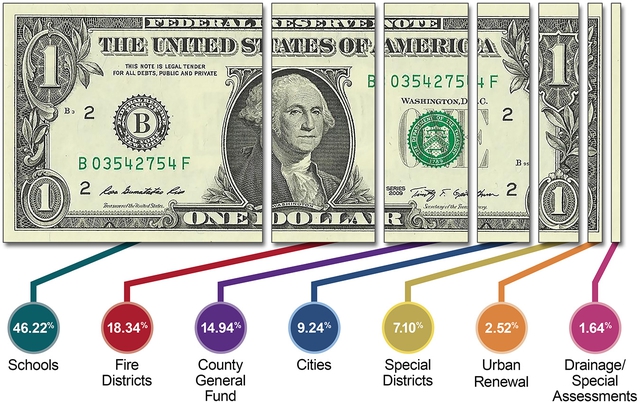

Here’s the breakdown:

- Schools: $45,448,307 – 46.22 percent

- Fire Districts: $18,038,421 – 18.34 percent

- Columbia County Government: $14,686,189 – 14.94 percent

- City Governments: $9,087,775 – 9.24 percent

- Special Districts: $6,982,100 – 7.10 percent

- Urban Renewal: $2,474,502 – 2.52 percent

- Drainage/Special Assessments: $1,613,898 – 1.64 percent

- TOTAL: $98,331,192

Tax rates vary based on the unique mix of taxing districts in a given location called a tax code area. There are 88 tax code areas in Columbia County. Your tax statement reflects the amount of tax collected for the districts providing services to your property in your tax code area. People who live in the city can often pay more than rural property owners because of the taxes that fund city parks, libraries, or local voter-approved bonds, among other benefits.

On the top left of your property tax statement is your code number. To see the exact charges for your specific code, go to the county Assessor’s webpage at columbiacountyor.gov and open the 2023-24 Summary of Assessment & Tax Roll. The document contains a list of all agencies in the county that receive the taxes.

The vast majority of taxes – 46 percent – goes towards education, including five school districts, one educational service district, and Portland Community College.

Fire districts receive more than 18 percent of the total. These districts cover the entire county, from Vernonia to Clatskanie to Scappoose.

# # #

ABOUT COLUMBIA COUNTY'S PROPERTY TAXES

The county tax assessor, an elected official, regulates property taxes and bases them on the most recent property value assessment for homes, businesses, and land. For more information about your Columbia County property valuation, or if you believe your property tax assessment was unfair, contact the county Assessor’s office at 503-397-2240. All tax appeals are due to the County Clerk no later than January 2, 2024.

FOR IMMEDIATE RELEASE: PN-Property Tax Statements Mailed; Where Does Your Money Go?

The Columbia County Finance and Taxation Department recently sent taxpayers their annual statement. Payments are due by November 15, 2021.

Property taxes pay for a number of critical services. These include public safety (law enforcement, fire and emergency services), parks, schools, public transportation, public defense, elections, community justice, and a host of other important municipal services.

Columbia County will collect $86,053,943 in taxes from both businesses and private landowners this year. But the majority of that amount doesn’t stay in county coffers – only 9.64 percent, or roughly $8.3 million, goes into the county’s general fund. An additional 3.95 percent, or $3.4 million, goes to the Jail Operation Fund from the local option levy approved by county voters.

General fund dollars largely pay for county law enforcement and public safety, including Columbia County Sheriff’s Office, jail operations, and the district attorney’s office. The remainder pays for general county administration, including the assessor’s office, land development services, juvenile services, and the county commission. More than 85 percent of property tax funds collected are distributed to local schools, cities, and special districts, such as those that manage 911 services or soil and water conservation, to name a few.

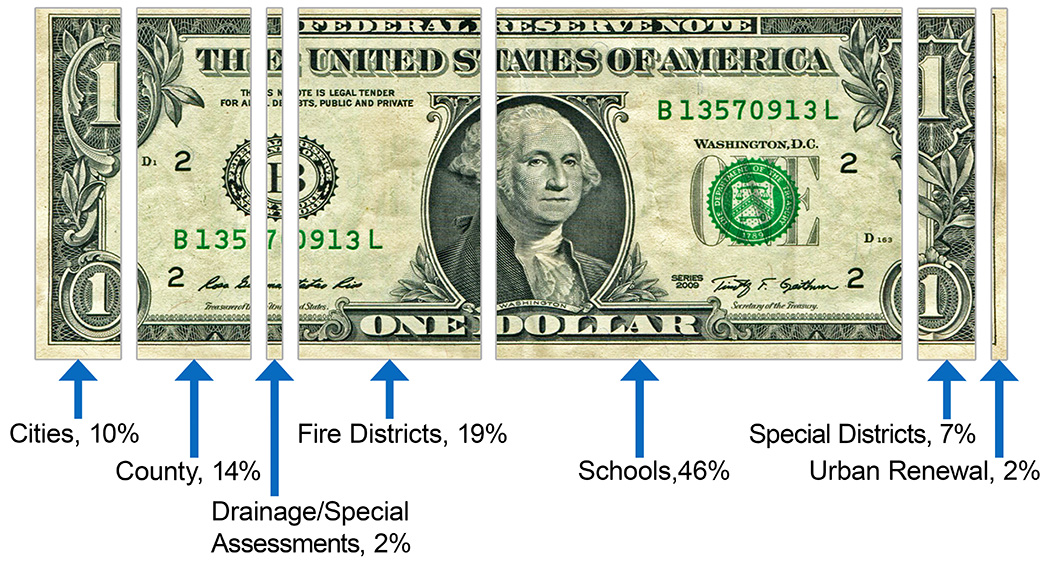

Here’s the breakdown:

- Schools: $40,071,980 - 46 percent

- Fire Districts: $16,578,566 - 19 percent

- Columbia County Government: $11,789,404- 14 percent

- City Governments: $8,376,182 - 10 percent

- Special Districts: $6,429,123 – 7 percent

- Urban Renewal: $1,365,680 - 2 percent

- Drainage/Special Assessments:$1,443,008 - 2 percent

- TOTAL: $86,053,943

There was one new voter-approved local option levy for the Rainier Cemetery District. Those with properties within that district will see a line item of $.05 per thousand of assessed value on their tax statement.

Another local option levy to note is that of the Scappoose Rural Fire Department. Voters within this district approved an increase of $.75 to the district. This brings their rate from $1.24 per thousand of assessed value to $1.99 per thousand of assessed value.

Columbia County has 91 tax code areas that are comprised of various combinations of taxing districts that serve that area. Therefore, where your property is located dictates the rate and type of taxes you pay. City dwellers can often pay more than rural property owners because of local taxes that go to parks, libraries, or local voter-approved bonds, among other benefits.

On the top left of your property tax statement is your code number. To see the exact charges for your specific code, go to the county Assessor’s webpage at columbiacountyor.gov and open the 2021-22 Summary of Assessment & Tax Roll. The document contains a list of all agencies in the county that receive the taxes.

The vast majority of taxes – 46 percent – goes towards education, including five school districts, one educational service district, and Portland Community College.

Fire districts receive more than 19 percent of the total. These districts cover the entire county, from Vernonia to Clatskanie to Scappoose.

The county tax assessor, an elected official, regulates property taxes and bases them on the most recent property value assessment for homes, businesses, and land. For more information about your Columbia County property valuation, or if you believe your property tax assessment was unfair, contact the county Assessor’s office at 503-397-2240. All tax appeals are due to the County Clerk no later than January 3, 2022.

FOR IMMEDIATE RELEASE: NR-Property Tax Payments Due November 15, 2021

Columbia County offers discounts, online payment options, and tax account information

Columbia County expects to begin mailing property tax statements, a combination valuation notice and tax bill, to property owners during the week of Oct. 18, 2021. Property owners should receive statements from the Columbia County Tax Collector by Oct. 30th. Property tax payments are due by Nov. 15, 2021.

The County recognizes that members of the community are experiencing economic challenges because of COVID-19. However, Oregon state law sets the deadline that property tax payments are due and requires the County to charge interest on properties with delinquent tax amounts. Columbia County does not have the authority to waive interest charges as a result of late property tax payments, and the Oregon State Legislature has not, at this time, extended the property tax deadline.

Property owners can receive a discount by paying in full or pay in installments to better manage the obligation. Taxpayers who pay the full 2021 property tax by Nov. 15, 2021, or submit a full payment postmarked by that date will receive a 3 percent discount. Taxpayers who pay two-thirds of the 2021 property tax by Nov. 15, 2021, or have the two-thirds payment postmarked by that date, will receive a 2 percent discount. Taxes may also be paid — without discount — in three, one-third installments due Nov. 15, 2021; Feb. 15, 2022; and May 15, 2022.

To protect the health and safety of the Columbia County community during the COVID-19 pandemic, the County is encouraging people to pay using one of our contact-free options below.

Taxpayers can pay their taxes:

- Online: Visit columbiacountyor.gov/pay-online for more information on the various online payment options including electronic check. Convenience fees apply.

- By phone: 1-866-587-4007, Point and Pay’s automated phone system is available 24 hours a day, seven days a week. Options include an electronic check, credit, and debit card. Convenience fees apply.

- 24-hr drop box: Our contact-free payment drop box is located in the North parking lot of the Columbia County Courthouse. It will be checked each business day for payments to be applied to property tax accounts. Checks only, no cash.

- By mail: Send only a check or money order, do not mail cash. Your canceled check is proof of payment. Remember to sign your check and apply the proper postage to the envelope. Mail payments early to avoid any problems with postmarking at the post office.

- Make your check payable to Columbia County Tax Collector or C.C.T.C.

Mail all property tax payments to:

Columbia County Tax Collector

230 Strand St.

St. Helens, OR 97051 (Include your Tax ID #)

- In-person: Our Tax Clerks accept cash or check with no additional fees. Credit and Debit Card payments are accepted with the corresponding convenience fee. Tax payments can be made at the Columbia County Tax Office.

- Taxpayers coming to pay in person, please understand:

- We are located on the second floor of the Courthouse at 230 Strand Street, St. Helens, Oregon 97051.

- Tax payments can be made on weekdays from 8:30 a.m. to 5:00 p.m.

- Masks are required for service.

- Physical distancing guidelines must be followed.

- Taxpayers coming to pay in person, please understand:

Convenience Fees

Convenience fees are charged by Point & Pay, our online Payment Service Provider.

- Credit Cards (Visa, MasterCard, American Express, and Discover) are 2.5% of the payment amount.

- E-check is a flat fee of $1.50.

- MasterCard Debit Card is 2.5% of the payment amount.

- Visa Debit is a flat fee of $3.95.

For specific property account information (values, taxes, balances due, etc.), please visit columbiacountyor.gov/departments/TaxOffice/find-property-tax-records.

Remember, all Columbia County offices will be closed on Nov. 11, 2021, in observance of Veterans Day.