Paying Property Taxes

Payment Options

Paying by Drop Box

Our NEW Tax Payment (No Cash) Drop Box located by the Voters Ballot Box in the parking lot of the courthouse is available after June 1, 2020. It will be open Monday through Friday and checked daily for payments to be applied to property tax accounts, except holidays.

Paying in Person

Our Tax Clerks are available to serve you in the Columbia County Courthouse at 230 Strand Street St. Helens, Oregon 97051 on the second floor. We accept cash or check with no additional fees. However, we are able to process Credit and Debit Card payments for Property Taxes with the below mentioned Convenience Fees. Our office hours are Monday through Friday from 8:30 a.m. to 5:00 p.m.

Paying Online

Pay your property taxes online via credit, debit, or e-check online.

Convenience Fees:

You will be charged a convenience fee by Point & Pay, our online Payment Service Provider.

- Visa, MasterCard, American Express, and Discover Credit Cards are 2.5% of the payment amount with a minimum fee of $2.00.

- E-check is a flat fee of $1.50.

- MasterCard Debit Card is 2.5% of the payment.

- Visa Debit is a flat fee of $3.95.

Keep in mind:

- Click "submit" only once to ensure there is not a duplicate payment made.

- Once you have completed your transaction, it is always good to check your account online the next following day to make sure it has been applied to the correct account and confirm payment.

- Online payments that are returned from your bank for any reason will be charged a return payment fee of $35. Please make sure to double-check your banking information before you submit your payment.

You will need the following items when making your online payment:

- Your Columbia County property tax account number (located in the upper right corner of your tax statement).

- The amount of tax you choose to pay (payment options and amounts are on your statement).

- Your credit card information or bank routing and bank account numbers located on the bottom of your check.

You will need to follow the step-by-step guide below when making multiple account payments:

- Enter your first property tax account number (located in the upper right corner of your tax statement).

- The amount of tax you choose to pay (payment options and amounts are on your statement).

- Select Add another item to cart (right under the amount of tax you just entered to pay).

- Repeat this process until you have all your property tax accounts on your list to pay.

- Proceed to the Payment Information section and continue.

.png)

.png)

If you do not have your tax statement, you can view your Property Tax Records online or contact the Tax Office at 503-397-0060 for your account number and/or the current amount due.

Paying by Phone

You are able to pay by phone through Point & Pay, our online Payment Service Provider, at 1-866-587-4007.

Keep in mind:

- You will be charged a convenience fee by Point & Pay, our online Payment Service Provider, as mentioned above under the Paying Online section.

- NOTE: Visa Debit is NOT a recognized option when Paying by Phone as our online Payment Service Provider does not have a way at this time to have their IVR system pick up the flat fee of $3.95. Therefore, please make note that if you Pay by Phone with a Visa Debit, it will be ran with the same requirements as Visa, MasterCard, American Express, and Discover Credit Cards are with the 2.5% convenience fee of the payment amount with a minimum fee of $2.00.

You will need the following items when making your payment over the phone:

- Your Columbia County property tax account number (located in the upper right corner of your tax statement).

- The amount of tax you choose to pay (payment options and amounts are on your statement).

- Your credit card information.

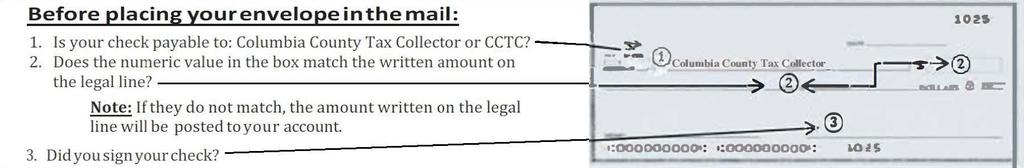

Paying by Mail

Send only a check or money order, DO NOT mail cash. Your cancelled check is proof of payment. Mail your payment in the windowed envelope provided in your tax statement. Remember to sign your check and apply the proper postage to the envelope.

Make your check payable to Columbia County Tax Collector or C.C.T.C.

Mail all property tax payments to:

Columbia County Tax Collector

230 Strand St.

St. Helens, OR 97051