Published on October 22, 2024

The Columbia County Finance and Taxation Department mailed annual property tax statements to property owners last week. Payments are due by November 15, 2024.

Property taxes fund critical public services, including law enforcement, fire and emergency services, parks, schools, public transportation, public defense, elections, community justice, and other essential municipal functions.

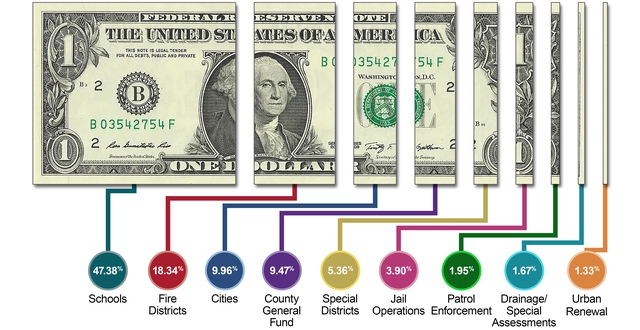

This year, Columbia County will collect $102,766,111.39 in property taxes from businesses and private landowners. However, the majority of this revenue doesn’t stay with the county—only about 9.47% (roughly $9.73 million) goes into the county’s general fund. An additional 3.90% ($4.01 million) is allocated to the Jail Operation Fund, supported by a local option levy approved by county voters. A second local option levy for the Sheriff’s Office will generate over $2 million (1.95% of the total tax collection) through the Enhanced Law Enforcement levy.

General fund dollars primarily support county law enforcement and public safety, including the Columbia County Sheriff’s Office, jail operations, and the District Attorney’s Office. The remainder funds general county administration, including the Assessor’s Office, Land Development Services, Juvenile Services, and the County Commission. Over 90% of property tax revenues are distributed to local schools, city governments, and special districts, such as those managing 911 services or soil and water conservation.

Here’s the breakdown:

- Schools: $48,693,307.68 – 47.38%

- Fire Districts: $19,503,749.86 – 18.98%

- City Governments: $10,231,399.97 – 9.96%

- Columbia County Government: $9,730,901.84 – 9.47%

- Special Districts: $5,506,228.47 – 5.36%

- Jail Operations: $4,012,882.67 – 3.90%

- Patrol Enforcement: $2,007,482.30 – 1.95%

- Drainage/Special Assessments: $1,715,720.41 – 1.67%

- Urban Renewal: $1,364,438.19 – 1.33%

- TOTAL: $102,766,111.39

Tax rates vary depending on the mix of taxing districts in each tax code area. Columbia County has 88 tax code areas, and your property tax statement reflects the amount collected for the services provided in your area. Residents of cities often pay higher taxes than rural property owners because their taxes fund additional services like city parks, libraries, or voter-approved bonds.

Your tax code number is located in the upper left corner of your property tax statement. To view the specific charges for your tax code area, visit the county Assessor’s webpage at columbiacountyor.gov and open the 2024-25 Summary of Assessment & Tax Roll, which lists all agencies receiving property taxes.

The largest share of tax revenue—47.38%—supports education, which includes five school districts, one educational service district, and Portland Community College.

Fire districts receive over 18.98% of total tax revenue, serving the entire county from Vernonia to Clatskanie to Scappoose.

# # #

ABOUT COLUMBIA COUNTY'S PROPERTY TAXES

The County Tax Assessor, an elected official, regulates property taxes based on the most recent property value assessments for homes, businesses, and land. For more information about your Columbia County property valuation, or if you believe your property tax assessment is inaccurate, contact the County Assessor’s Office at 503-397-2240. All tax appeals must be filed with the County Clerk by December 31, 2024.